Table of Contents

UPI (Unified Payments Interface) has revolutionized how we make payments in India. With its seamless and convenient interface, UPI has become the go-to choice for millions of Indians to make quick and secure payments. However, with convenience comes the risk of fraud and cyber threats. It’s essential to stay vigilant and take precautions to protect yourself while making UPI payments.

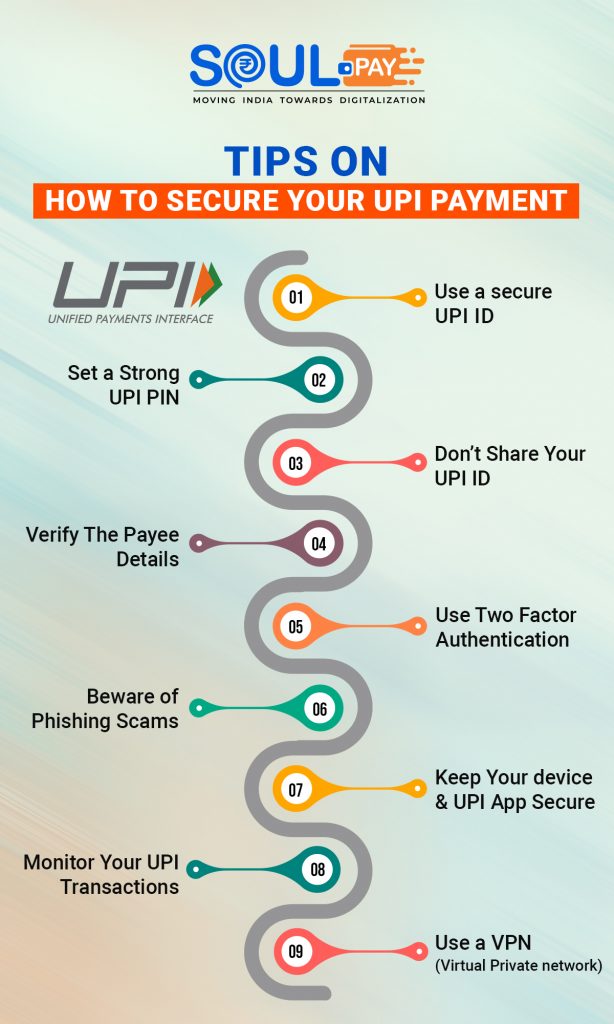

Tips On How To Stay Secure While Using UPI Payments

Use A Secure UPI App

It’s essential to use a UPI app that’s secure and trusted. Ensure you download the app from a reliable source, such as the Google Play Store or Apple App Store. Before downloading an app, review and rate it. Also, ensure that the app is updated to the latest version as updates often contain security patches and bug fixes.

Set A Strong UPI PIN: UPI Payments

Require you to enter a UPI PIN, which is a four or six-digit code used to authenticate transactions. It’s crucial to set a strong UPI PIN that’s difficult for others to guess. As your UPI PIN, stay away from using your date of birth, phone number, or any other numbers that are simple to guess.

Don’t Share Your UPI ID Or Mobile Number

Your UPI ID or mobile number linked to your UPI account is sensitive information that should be kept private. Avoid sharing this information on social media or other public forums. Only share your UPI ID or mobile number with trusted individuals or businesses when making payments.

Verify The Payee Details

Before making a payment, ensure that you have entered the correct UPI ID or mobile number of the payee. Always double-check the payee details before initiating a transaction. It’s also a good practice to verify the payee’s name and account details before making a payment.

Use Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your UPI payments. With 2FA, you’ll need to enter a one-time password (OTP) sent to your registered mobile number to authenticate a transaction. Make sure you enable 2FA in your UPI app settings for added security.

Beware Of Phishing Scams

Phishing scams are common in the digital world, and UPI payments are not immune to them. Be wary of emails, text messages, or phone calls asking you to provide your UPI ID or other personal information. Avoid opening attachments or clicking on links coming from unidentified sources. Before sending any personal information, always be sure the communication is genuine.

Keep Your Device And UPI App Secure

Ensure your device is protected by a strong password or biometric authentication. Avoid installing apps from unknown sources, as they may contain malware that can compromise your UPI app’s security. Keep your UPI app logged out when not in use, and never save your UPI PIN or other sensitive information on your device.

Monitor Your UPI Transactions

Regularly check your UPI transaction history to detect any unauthorized transactions. If you notice any suspicious activity, immediately report it to your bank or UPI app provider. It’s also a good practice to keep track of the transactions you have initiated to avoid any confusion or discrepancies in your account.

Use a virtual private network (VPN)

When making UPI payments over public Wi-Fi networks, consider using a virtual private network (VPN) to encrypt your data and protect it from prying eyes. A VPN creates a secure tunnel between your device and the internet, preventing unauthorized access to your data.